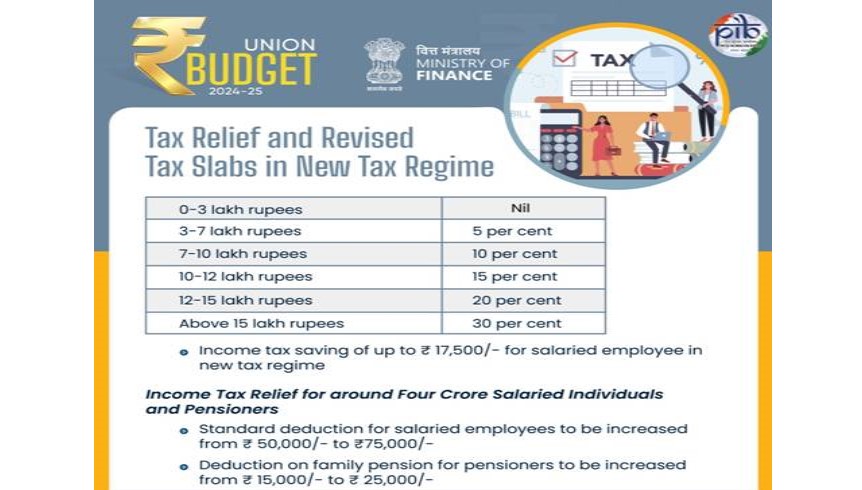

In the Union Budget 2023-24 presented by finance minister Nirmala Sitharaman, the government has increased standard deduction of salaried employees from Rs. 50,000/- to Rs. 75,000/- for those opting for new tax regime. Similarly, deduction on family pension for pensioners enhanced from ₹ 15,000/- to ₹ 25,000/-.

Assessments now, can be reopened beyond three years up to 5 years from end of year of assessment, only if, the escaped income is more than ₹ 50 Lakh. The new tax regime rate structure is also revised to give a salaried employee benefits up to ₹ 17,500/- in income tax.

“Short term gains shall henceforth attract a rate of 20 per cent on certain financial assets. Long term gains on all financial and non-financial assets to attract 12.5 per cent rate. Limit of exemption of capital gains has been increased to ₹1.25 Lakh per year to benefit lower and middle-income classes.”

On Capital gains, short term gains shall henceforth attract a rate of 20 per cent on certain financial assets. Long term gains on all financial and non-financial assets to attract 12.5 per cent rate. Limit of exemption of capital gains has been increased to ₹1.25 Lakh per year to benefit lower and middle-income classes. Listed financial assets held for more than a year and unlisted assets (financial and non-financial) held for more than two years to be classified as long term assets. Unlisted bonds and debentures, debt mutual funds and market linked debentures will continue to attract applicable capital gains tax.

To promote investment and foster employment, the budget has given boost to entrepreneurial spirit and start-up ecosystem, abolishing angel tax for all classes of investors. Further, a simpler tax regime for foreign shipping companies operating domestic cruises is proposed looking at the tremendous potential of cruise tourism. Foreign mining companies selling raw diamonds in the country can now benefit from safe harbor rates which will benefit the diamond industry. Further, corporate tax rate on foreign companies reduced from 40 to 35 per cent to attract foreign capital.

“Corporate tax rate on foreign companies reduced from 40 to 35 per cent to attract foreign capital.”

The budget further simplified the direct tax regime for charities, TDS rate structure and capital gains taxation. The two tax exemption regimes for charities will be merged into one. 5 per cent TDS on many payments to be merged into 2 per cent TDS and 20 per cent TDS on repurchase of units by mutual funds or UTI stands withdrawn. TDS rate on e-commerce operators reduced from 1 per cent to 0.1 per cent. Now credit of TCS will be given on TDS deducted from salary. Budget decriminalized delay of payment of TDS up to the due date of filing of TDS statement. Standard Operating Procedure soon for simplified and rationalized compounding guidelines for TDS defaults.

Union Minister Nirmala Sitharaman said that the government envisages further simplifying and rationalizing the tax structure to expand it to remaining sectors. Budget also proposed to further digitalise and make paperless the remaining services of Customs and Income Tax including rectification and order giving effect to appellate orders over the next two years.